Washington, United States

News Desk | National Affairs

Millions of U.S. taxpayers are checking the Internal Revenue Service’s Where My Refund tool as the 2026 filing season progresses, seeking updates on federal tax refunds submitted in recent weeks. According to the IRS, most electronically filed returns with direct deposit are processed within 21 days, though some refunds are taking longer due to verification reviews and error checks.

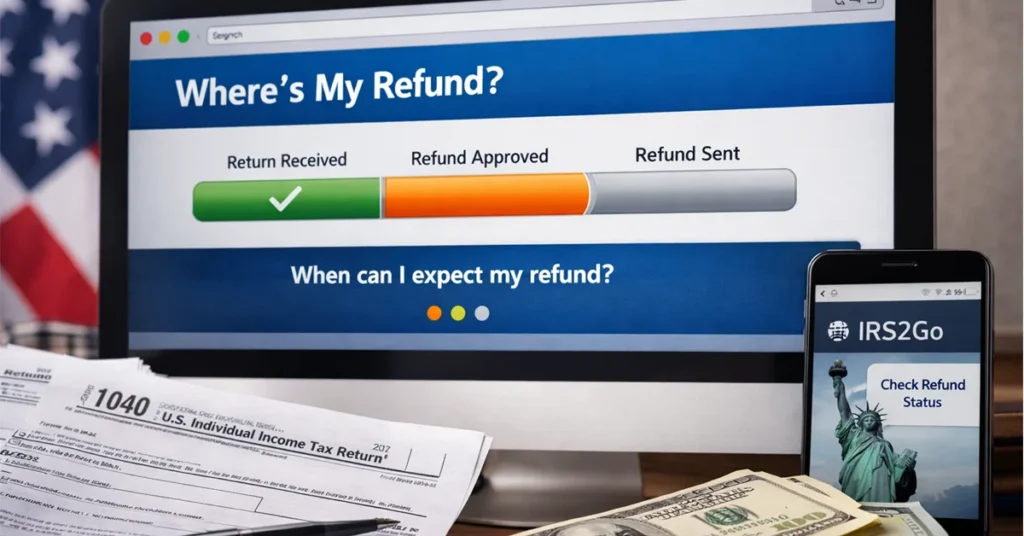

The IRS said the online tool, available on IRS.gov and through the IRS2Go mobile app, is updated once daily and remains the primary method for individuals to track the status of their refunds. Taxpayers must provide a Social Security number, filing status, and exact refund amount to access updates.

According to the Internal Revenue Service, delays can occur when returns require additional review for identity verification, incomplete information, or claims involving credits such as the Earned Income Tax Credit or Additional Child Tax Credit. By law, refunds tied to certain credits cannot be issued before mid-February, even if returns are filed earlier.

IRS officials have also advised filers to avoid relying on third-party estimates or assuming approval dates based on prior years. The agency said contacting IRS call centers will not speed up processing and that phone representatives have access to the same information shown in the tracking tool.

The Where My Refund tracker typically displays three stages: return received, refund approved, and refund sent. Once marked as sent, direct deposits generally reach bank accounts within five business days, while paper checks may take several weeks, according to the agency.

Tax professionals say increased use of electronic filing and direct deposit continues to reduce wait times overall, but backlogs from manual reviews still affect a portion of returns each year.

The IRS said taxpayers who do not see an update after 21 days for e-filed returns, or six weeks for mailed returns, should then consider contacting the agency for assistance. The story is developing.

ALSO READ: Haaland Returns To Training As Manchester City Monitor Fitness